Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the

Federal Poverty Level will receive combined subsidies, making many health plans have zero premiums. Adults making less than 401% of the FPL get an extra $100 a month, and incomes between 401% to 600% of the FPL will get $50 a month.

Children dependents under age 19 default to the Children's Health Insurance Program at zero cost if the household earns less than 355% of the FPL. The adults receive the NJHPTC as indicated above. If the child is over 18, they are treated as an adult, getting up to an additional $100 credit per child under 400% of the FPL and $50 from 401% up to 600% of the FPL.

The CHIP insures over one million children in NJ, and growing the pool is a priority to move to a one-payer system. To avoid a child's eligibility for CHIP, the family must report an income over 355% of the FPL, or they can refuse the free coverage and enroll their children in a non-subsidized plan through the same insurance companies offered to adults. The

Child Health Insurance Program offers comprehensive coverage, including dental and vision.

When a state takes funds from the health industry and hospitals to fund the subsidy, insurance companies and hospitals will pass the cost on to all users, increasing the overall cost. Eventually, as small group premiums increase, many employers will stop offering group coverage and direct employees to purchase subsidized individual plans. The Family Glitch Fix will further enlighten employers about how little individuals pay for health insurance. The fix allows dependents of employees covered by group health plans to enroll in subsidized individual health plans if the household cost is determined unaffordable. Groups under 50 employees do not have a penalty for not offering health insurance, so when the cost can be sliced in half, an employer's premium contributions may be better allocated to other benefits or an increase in pay.

The subsidy programs aim to balance the cost burden across different groups, with the hope that increased access to healthcare will ultimately lead to better health outcomes and lower overall healthcare costs in the long run. With over forty years of experience, I feel usage will increase, moral hazard will not lead to better healthcare outcomes, and participants will demand the entitlement to be maintained while others pay the cost.

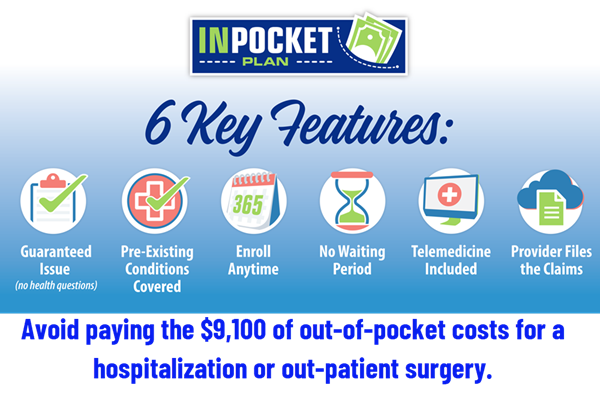

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now having two insurance plans offer lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,450 per individual and $18,900 per family 2024. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a faction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accident. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

In an ever-changing healthcare landscape, arming yourself with knowledge about health insurance is vital not only for your physical health but also for your financial security. A new insurance plan offers relief to individuals covered by Affordable Care individual health plans regardless of medical conditions and without the standard exclusions. Now having two insurance plans offer lower out-of-pocket costs than one. The MOOP (maximum out-of-pocket) expenses will be $9,450 per individual and $18,900 per family 2024. Tiered health plans can speed up your obligations. Start saving or read on.

In the insurance industry, one thing remains consistent. 20% of people use 80% of healthcare expenses. Since the Obama Care began, individuals have been insured regardless of their pre-existing conditions or medical expenses. Premium costs have been increasing every year since the law was passed. However, for many participants, the actual premium cost is not obvious as the subsidies granted by the Affordable Care Act offset the increases. What is apparent is that the out-of-pocket costs are increasing and are unaffordable for the average family.

For many, hospital indemnity insurance plans fill the gap for a faction of the cost of buying up to gold health plans. However, not all states allow hospital indemnity plans to be offered to individuals. Most do not cover the significant upfront costs on the first day in the hospital, and few cover outpatient surgeries. Most are also unavailable to people with pre-existing conditions, and just about all do not cover maternity and mental health expenses.

Life happens, and everyone needs to set up an emergency fund or leverage their limited funds. Solutions now exist to cover your medical bills for accidents only or both sickness and accident. Do the math to save money by comparing the MOOP and premiums on bronze, silver, and gold individual health plans. People covered by tiered networks (i.e., Proactive Plans) must understand that an ambulance takes you to the nearest hospital regardless of tier status or network. (St Mary's is Tier 3 with Keystone Proactive Plans). Consider lowering your out-of-pocket costs for families planning on more children or baby boomers with a higher risk of hospitalization. Sleep better knowing you can afford to be taken to the nearest hospital or get treated without the risk of medical bankruptcy.

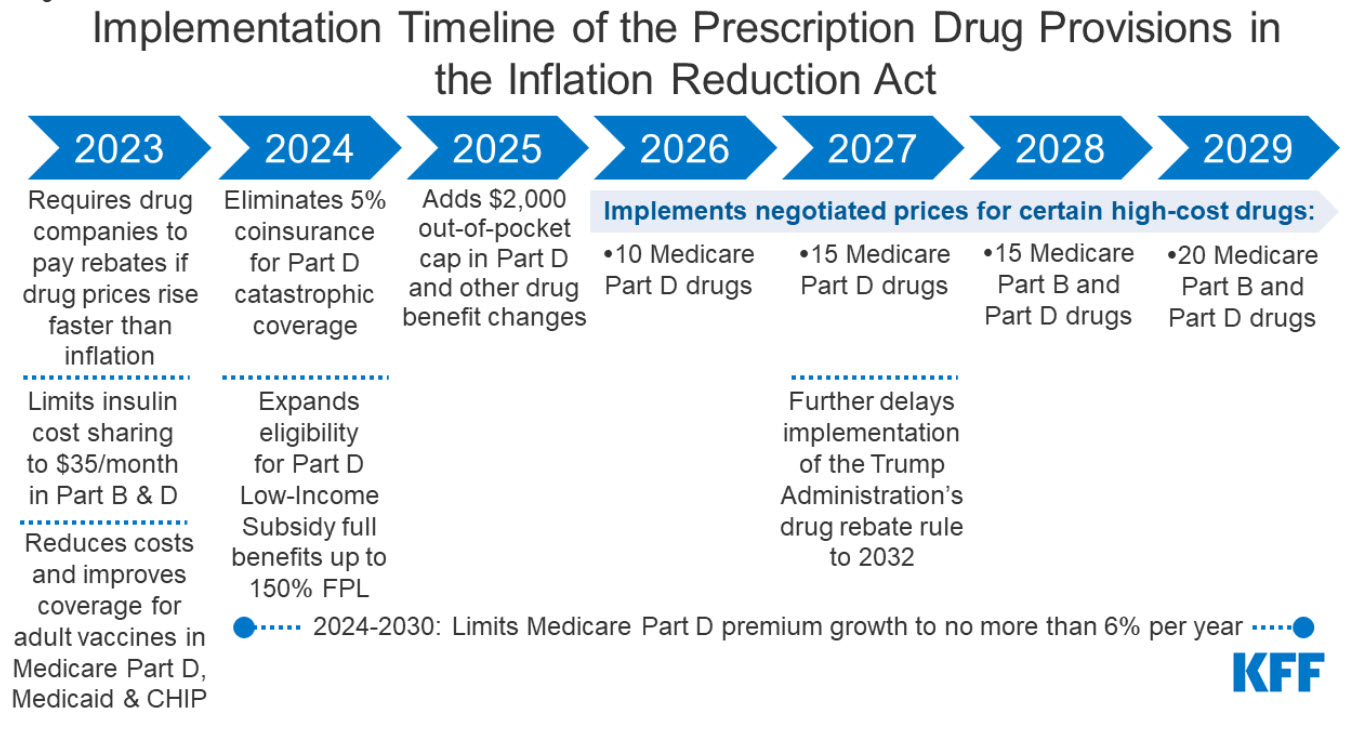

Staying informed about changes to Medicare Part D medication coverage is essential for understanding how these updates may impact healthcare expenses and treatment options. This blog post will explore the recent Medicare Part D medication coverage improvements that the Infl initiated by the Inflation Reduction Act.

1. The law requires the federal government to negotiate prices for some high-cost drugs covered under Medicare. Medicare Part D and Part B drug spending are highly concentrated among a relatively small share of covered drugs, mainly those without generic or biosimilar competitors. Under the Inflation Reduction Act, brand-name and biologic drugs without generic or biosimilar equivalents covered under Medicare Part D that are among the highest-spending Medicare-covered drugs are eligible for negotiation. The number of negotiated drugs is limited to 10 Part D drugs in 2026, another 15 Part D drugs in 2027, another 15 Part B and Part D drugs in 2028, and another 20 Part B and Part D drugs in 2029 and later years.

2. Requires drug manufacturers to pay rebates to Medicare if they increase prices faster than inflation for drugs used by Medicare beneficiaries. The inflation rebate provision will be implemented in 2023, using 2021 as the base year for determining price changes relative to inflation.

3. Caps Medicare beneficiaries' out-of-pocket spending under the Medicare Part D benefit, first by eliminating coinsurance above the catastrophic threshold in 2024 and then by adding a $2,000 cap on spending in 2025. The law also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

4. Limits cost-sharing for insulin to $35 per month for people with Medicare, beginning in 2023, including covered insulin products in Medicare Part D plans, beginning January 1, 2023, and for insulin furnished through durable medical equipment under Medicare Part B, beginning July 1, 2023.

5. Eliminates cost-sharing for adult vaccines covered under Medicare Part D, as of 2023, and improves access to adult vaccines under Medicaid and CHIP.

6. Expands eligibility for full Part D Low-Income Subsidies (LIS) in 2024 to low-income beneficiaries with incomes up to 150% of poverty and modest assets and repeals the partial LIS benefit currently in place for individuals with incomes between 135% and 150% of poverty.

7. Expanded Medication Therapy Management (MTM) Services: MTM services have been expanded to provide enhanced support and guidance. This helps ensure effective medication use, improves health outcomes, and minimizes drug-related issues.

8. Enhanced Information and Decision-Making Tools: Beneficiaries now have improved resources for informed decision-making. The updated Plan Finder tool offers accurate cost estimates and helps select the most suitable Part D plan based on individual medication needs.

Conclusion: Staying updated on Medicare Part D medication coverage changes is crucial for beneficiaries seeking affordable and necessary prescription drugs. Recent enhancements, including improved coverage in the donut hole, biosimilar discounts, expanded catastrophic coverage threshold, expanded MTM services, and enhanced information tools, contribute to greater affordability and accessibility. Beneficiaries are encouraged to remain informed, review their Part D plan regularly, and utilize available resources to make informed decisions about prescription drug coverage.

Disclaimer: The information provided is for educational purposes only and not legal or financial advice. Consult a qualified professional for personalized guidance regarding your specific situation.

Staying informed about changes to Medicare Part D medication coverage is essential for understanding how these updates may impact healthcare expenses and treatment options. This blog post will explore the recent Medicare Part D medication coverage improvements that the Infl initiated by the Inflation Reduction Act.

1. The law requires the federal government to negotiate prices for some high-cost drugs covered under Medicare. Medicare Part D and Part B drug spending are highly concentrated among a relatively small share of covered drugs, mainly those without generic or biosimilar competitors. Under the Inflation Reduction Act, brand-name and biologic drugs without generic or biosimilar equivalents covered under Medicare Part D that are among the highest-spending Medicare-covered drugs are eligible for negotiation. The number of negotiated drugs is limited to 10 Part D drugs in 2026, another 15 Part D drugs in 2027, another 15 Part B and Part D drugs in 2028, and another 20 Part B and Part D drugs in 2029 and later years.

2. Requires drug manufacturers to pay rebates to Medicare if they increase prices faster than inflation for drugs used by Medicare beneficiaries. The inflation rebate provision will be implemented in 2023, using 2021 as the base year for determining price changes relative to inflation.

3. Caps Medicare beneficiaries' out-of-pocket spending under the Medicare Part D benefit, first by eliminating coinsurance above the catastrophic threshold in 2024 and then by adding a $2,000 cap on spending in 2025. The law also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

4. Limits cost-sharing for insulin to $35 per month for people with Medicare, beginning in 2023, including covered insulin products in Medicare Part D plans, beginning January 1, 2023, and for insulin furnished through durable medical equipment under Medicare Part B, beginning July 1, 2023.

5. Eliminates cost-sharing for adult vaccines covered under Medicare Part D, as of 2023, and improves access to adult vaccines under Medicaid and CHIP.

6. Expands eligibility for full Part D Low-Income Subsidies (LIS) in 2024 to low-income beneficiaries with incomes up to 150% of poverty and modest assets and repeals the partial LIS benefit currently in place for individuals with incomes between 135% and 150% of poverty.

7. Expanded Medication Therapy Management (MTM) Services: MTM services have been expanded to provide enhanced support and guidance. This helps ensure effective medication use, improves health outcomes, and minimizes drug-related issues.

8. Enhanced Information and Decision-Making Tools: Beneficiaries now have improved resources for informed decision-making. The updated Plan Finder tool offers accurate cost estimates and helps select the most suitable Part D plan based on individual medication needs.

Conclusion: Staying updated on Medicare Part D medication coverage changes is crucial for beneficiaries seeking affordable and necessary prescription drugs. Recent enhancements, including improved coverage in the donut hole, biosimilar discounts, expanded catastrophic coverage threshold, expanded MTM services, and enhanced information tools, contribute to greater affordability and accessibility. Beneficiaries are encouraged to remain informed, review their Part D plan regularly, and utilize available resources to make informed decisions about prescription drug coverage.

Disclaimer: The information provided is for educational purposes only and not legal or financial advice. Consult a qualified professional for personalized guidance regarding your specific situation.

Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the

Using NJ state and federal subsidies, the Affordable Care Act (ACA) helps eligible individuals and families afford health insurance. The American Rescue Plan Act has increased the amount of financial help available, with no one paying more than 8.5% of their income for health insurance when not offered affordable group health insurance through work. New Jersey has its own subsidy program, the New Jersey Health Insurance Premium Tax Credit (NJHPTC), funded by state taxes, fees, and assessments on health insurance companies and hospitals, as well as the state's general fund. However, NJ added subsidy may cause small employers to stop offering group health plans.

To be eligible for NJHPTC, individuals, and families must meet certain income requirements, and the amount of subsidy varies based on the number of insured individuals. For example, an individual making 150% of the